Home/Blog

Revup Blog

Recurring Payments: Definition, Types, and Benefits

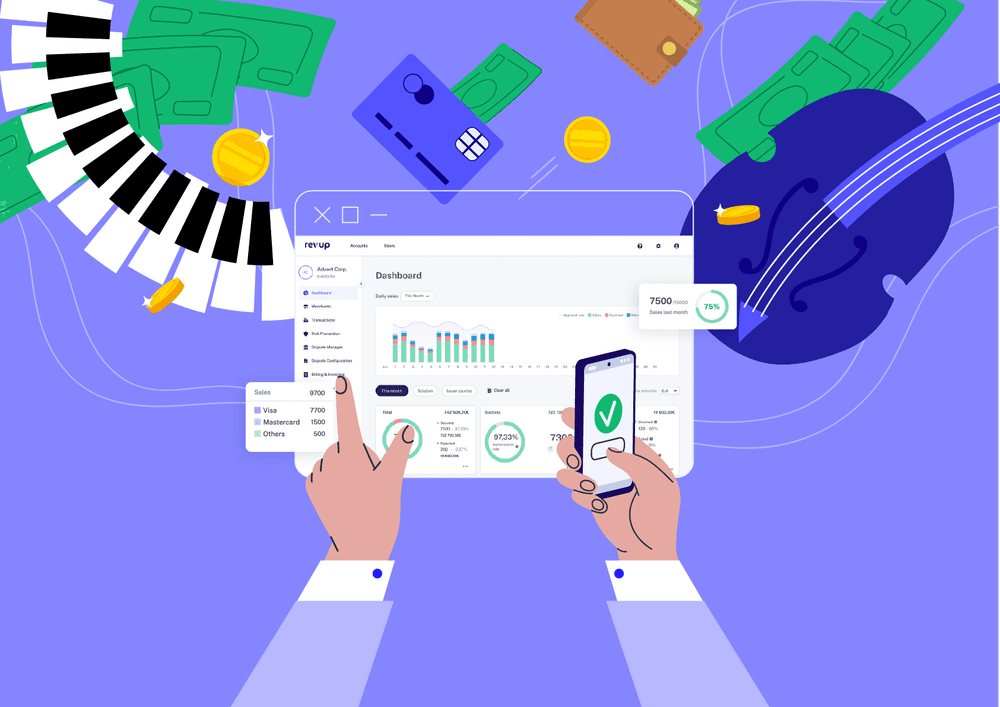

Meet Revup: The revenue optimization orchestrator turning payment challenges into growth

Industry

Macropay Payment Orchestrator has officially rebranded as Revup, marking a new era in revenue optimization. Built from over a decade of payments expertise, Revup puts merchants in control with token ownership, adaptive routing, and revenue-first features proven to recover nearly a quarter of failed transactions.

Barcelona, [1st September] - Revup, a revenue optimization orchestrator that helps merchants turn payments into profits, officially launches today. What began as an internal solution to streamline payments has evolved into a global platform designed to help businesses recover more revenue, strengthen compliance, and scale with confidence.

Merchant ID: What It Is, How It Works, and How To Get It

Industry

Did you know that large restaurant chains or retailers with multiple locations often use different MIDs for each point of sale or line of business?

This approach not only helps them optimize payment management but also enables detailed sales tracking and more efficient risk management.

Discover how this simple identifier can revolutionize the way you handle your transactions and improve your payment processes. Here’s everything you need to know.

How Does the Credit Card Payment Process Work?

Payment Processing

Accepting credit card payments is critical for any business looking to grow and stay competitive.

However, behind every card transaction lies a complex process involving multiple players, such as issuing banks, acquirers, and payment processors.

Understanding how this system works helps you:

- Optimize business operations

- Minimize risks

- Reduce costs

- Improve customer experience

In this article, we break down each stage of card payment processing and explain how understanding it can help you drive your business forward.

Recurring Payments: Definition, Types, and Benefits

Industry

Did you know that some of our recurring customers have increased their profits by 20% as a result of a good retry strategy?

In this article, you’ll find out how you can transform your business model by applying recurring payment processing and increasing your profit.

How BINs protect your business and improve the security of your online payments

Payment Processing

Have you ever wondered how big companies avoid fraud in digital payments?

Bank Identification Numbers (BINs) are the key they use to protect themselves and streamline each transaction.

In this Revup article, you will find out how BINs can improve the security of your online business, reduce risks, and make your operations more efficient.

Payment Orchestrators: What Are They, How They Operate, and How to Choose One

Payment Processing

Payment orchestration platforms are an essential tool for e-commerce businesses aiming to improve the efficiency and effectiveness of their payment procedures.

As an e-commerce entrepreneur or manager, you’ve probably faced challenges such as integrating multiple payment methods, reducing costs, and improving the customer experience.

In this article, you’ll discover how payment orchestrators, especially Revup, can help you overcome these challenges and take your business to the next level.

Disputes and Chargebacks: A Complete Guide to Protecting Your Business

Fraud prevention

Did you know that Mastercard process 615 million chargebacks every year? According to the company’s figures, the average cost is $191 per transaction.

Don’t let misunderstandings put your business at risk!

Learn how to manage disputes and chargebacks and protect your income and reputation.

Optimize your revenue

Request a demo to see how Revup works!

Stay tuned for updates

Follow us on LinkedIn!